Property Cash Flow Investments in New York: Your Overview to Generating Passive Earnings

Property cash flow financial investments have long been a reliable method to construct wealth and produce easy income. In a dynamic market like New York, possibilities abound for savvy financiers to safeguard buildings that generate consistent cash flow. From busy metropolitan facilities to suv retreats, New York provides diverse realty choices to fit different financial investment approaches. Below's your overview to understanding and making the most of real estate cash flow investments in New york city.

What Are Property Capital Investments?

Capital investments in real estate refer to properties that generate revenue surpassing the costs of ownership, such as home mortgage settlements, maintenance, taxes, and insurance. Favorable capital offers a steady revenue stream, making it an appealing technique for long-lasting wealth structure.

In New York, capital homes can range from multi-family homes and single-family leasings to commercial buildings and getaway services. The key is recognizing locations and property kinds that straighten with your financial objectives.

Why Buy New York Realty for Capital?

High Rental Demand

New York's diverse populace and vibrant economic climate make certain consistent demand for rental buildings. Urban centers like New York City, suburban areas in Long Island, and picturesque upstate areas bring in a vast array of lessees, from experts to trainees and vacationers.

Strong Market Recognition

While capital is the main emphasis, New york city buildings often benefit from long-term gratitude, adding an additional layer of productivity to your financial investment.

Diverse Financial Investment Opportunities

New York offers residential or commercial properties throughout a vast range, including deluxe homes, multi-family systems, and commercial rooms, enabling investors to customize their approaches based on their competence and budget.

Tourist and Seasonal Rentals

Places like the Hudson Valley and the Adirondacks thrive on tourist, making short-term and mid-term rental investments very financially rewarding.

Top Locations for Capital Investments in New York

New York City City

The 5 boroughs-- Manhattan, Brooklyn, Queens, Bronx, and Staten Island-- use countless chances for capital investments. Multi-family homes and mixed-use residential or commercial properties in external boroughs are specifically appealing for consistent rental earnings.

Long Island

Suv Long Island offers possibilities for single-family rentals and villa, especially in locations like the Hamptons and North Fork.

Upstate New York

Areas like Albany, Saratoga Springs, and Buffalo have actually seen growing demand for budget friendly housing, making them outstanding areas for cash money flow-focused investments.

Hudson Valley

A hotspot for getaway services, the Hudson Valley brings in tourists and long-term tenants alike. Quality below supply a mix of price and high returns.

Western New York

Cities like Rochester and Syracuse are known for their cost and strong rental need, making them suitable for capitalists looking for residential properties with reduced purchase prices and higher returns.

Sorts Of Capital Investment Residences

Multi-Family Homes

Multi-family residential properties, such as duplexes and apartment buildings, are among the most effective for constant cash flow. The numerous systems provide varied income streams, lowering threat.

Single-Family Leasings

Single-family homes offer security and are simpler to take care of. These are prominent in suv markets like Long Island and parts of upstate New York.

Trip Rentals

High-tourism locations like the Adirondacks or the Hamptons can yield considerable revenue through temporary rental platforms like Airbnb.

Industrial Properties

Retail areas, office complex, and mixed-use residential or commercial properties in city areas can supply high returns, especially in busy downtown.

Steps to Be Successful in Property Capital Investments

Evaluate Prospective Capital

Compute your residential or commercial property's anticipated earnings and deduct all expenses. This consists of car loan payments, tax obligations, insurance coverage, maintenance, https://sites.google.com/view/real-estate-develop-investment/ and building administration costs. Favorable cash flow is your goal.

Pick the Right Location

Study rental demand, openings rates, and ordinary rental revenue in your picked area. Select areas with strong economic development and tenant demand.

Safe Funding

Search for funding choices that straighten with your investment goals. Low-interest loans or collaborations can maximize your return on investment (ROI).

Partner with Building Monitoring Services

Specialist home monitoring firms can deal with occupant relationships, maintenance, and rent collection, guaranteeing a smooth financial investment experience.

Take Advantage Of Tax Benefits

Realty investments use tax obligation benefits, such as depreciation and deductions for upkeep costs, decreasing your gross income.

Typical Challenges and How to Overcome Them

High Initial Expenses

New York realty is understood for its high building worths, particularly in metropolitan locations. Take into consideration beginning with smaller homes or investing in arising markets upstate.

Occupant Turnover

High tenant turn over can reduce capital. Screen occupants thoroughly and offer incentives for lasting leases to mitigate this risk.

Regulatory Difficulties

New York has rigorous rental laws and policies. Familiarize on your own with local regulations or hire an experienced property attorney to navigate these complexities.

The Future of Real Estate Capital Investments in New York City

The demand for rental residential properties in New york city remains solid, sustained by economic development, population variety, and tourist. Urban areas fresh York City continue to see high need, while upstate regions supply budget friendly entrance factors and promising returns.

As remote job trends grow, suv and rural areas are seeing an increase of renters, opening new opportunities for financiers. Furthermore, sustainability-focused growths and up-to-date homes are attracting higher rental fees, making them worthwhile financial investments.

Realty capital investments in New york city use a reputable way to construct riches and accomplish economic liberty. By choosing the right location, property kind, and management method, you can create a constant income stream and appreciate long-lasting admiration.

Whether you're a experienced financier or just starting, New york city's diverse market offers possibilities to fit your objectives. With careful preparation and market evaluation, you can turn your realty investments into a prospering resource of easy revenue.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Ben Savage Then & Now!

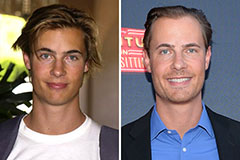

Ben Savage Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! David Faustino Then & Now!

David Faustino Then & Now!